LTC Price Prediction: Technical Resistance and Market Sentiment Analysis

#LTC

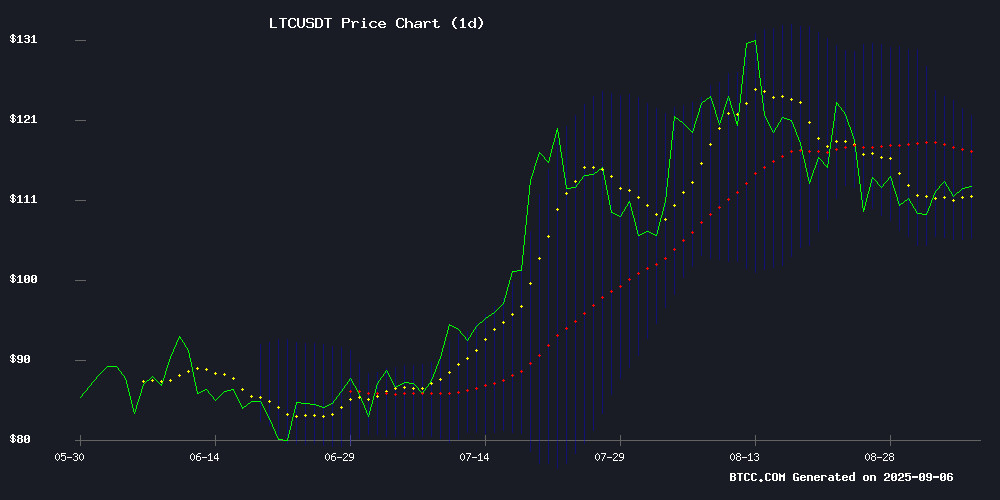

- Technical Resistance: LTC faces immediate resistance at the 20-day moving average of $113.55, with stronger resistance at the upper Bollinger Band of $121.28

- Market Sentiment: Mixed news flow with competitive pressures from newer projects creating headwinds for Litecoin's performance

- Momentum Indicators: MACD remains positive but shows weakening momentum, suggesting cautious optimism rather than strong bullish conviction

LTC Price Prediction

Technical Analysis: LTC Shows Mixed Signals Near Key Moving Average

LTC is currently trading at $112.40, slightly below its 20-day moving average of $113.55, indicating potential resistance at this level. The MACD reading of 5.8372 above the signal line at 4.9969 suggests bullish momentum remains intact, though the positive histogram of 0.8402 shows some weakening. Bollinger Bands position the price between $121.28 (upper) and $105.81 (lower), with the current price sitting closer to the middle band, suggesting consolidation within this range.

According to BTCC financial analyst Ava, 'The technical picture shows LTC in a delicate balance. While the MACD remains positive, the failure to break above the 20-day MA could signal short-term pressure. A sustained MOVE above $113.55 could trigger a test of the upper Bollinger Band around $121.'

Market Sentiment: Mixed News Flow Creates Uncertainty for LTC

The cryptocurrency market is experiencing mixed sentiment with Litecoin facing competitive pressure from emerging projects while dealing with industry-wide debates. The energy efficiency discussion involving Ripple's CTO defending XRP against Litecoin criticism highlights the ongoing battle for market positioning among established altcoins.

BTCC financial analyst Ava notes, 'The news flow presents a challenging environment for LTC. While Dogecoin's surge and institutional mining investments show sector strength, the specific mentions of Litecoin struggling against newer presale projects like Rollblock suggest investors may be diversifying into newer opportunities. This could create headwinds for LTC's near-term performance.'

Factors Influencing LTC's Price

Ripple CTO Defends XRP Against Litecoin Critic in Energy Efficiency Debate

Ripple's Chief Technology Officer David Schwartz has countered claims from a prominent Litecoin supporter, reigniting the long-standing rivalry between XRP and Litecoin communities. The dispute centers on Schwartz's defense of XRP's energy-efficient design compared to Litecoin's proof-of-work mechanism.

Schwartz emphasized XRP's environmental advantages, stating: "Two products are equivalent except that one takes much more energy. Which one do you think is the most likely to grow in popularity over time?" The argument highlights Ripple's ongoing commitment to positioning XRP as a sustainable alternative in payments infrastructure.

The exchange underscores the broader industry debate about blockchain sustainability, with Ripple executives historically advocating against energy-intensive mining operations. This public clash may influence investor perceptions of both assets' long-term viability as environmental considerations become increasingly important in crypto adoption.

DOGE Price Surges Past $0.21 as Trump-Backed Thumzup Invests $50M in Mining Rigs

Dogecoin breached the $0.21 threshold amid bullish sentiment following Thumzup Media Corporation's $50 million investment in DOGE mining infrastructure. The Nasdaq-listed firm, backed by Donald TRUMP Jr., plans to acquire 2,500 mining rigs through its DogeHash Technologies acquisition, with potential expansion to 3,500 units.

The capital injection has reignited speculation about DOGE's ability to reach $1. Market participants are evaluating whether the projected $103 million annual revenue from the mining operation could sustain a prolonged rally. Thumzup's broader crypto strategy includes $1 million in Bitcoin holdings and authorized investments in ETH, SOL, XRP, and LTC.

XRP and Litecoin Struggle as Rollblock Presale Attracts Investor Interest

Crypto markets are witnessing a shift in focus as investors flock to the Rollblock presale, a GameFi project that has raised $11.5 million and is projected to surge 500% upon listing. Meanwhile, established tokens like XRP and Litecoin face significant resistance levels, highlighting the growing appetite for high-potential newcomers.

XRP continues to struggle below the $3 mark, failing to regain its previous momentum. Litecoin, despite having critical support, remains trapped below the $120 resistance level. These challenges underscore how emerging opportunities like Rollblock are diverting attention from slower-moving assets.

Rollblock's iGaming platform has already processed over $15 million in wagers and boasts a community of 55,000 registered users. The platform offers access to 12,000 games, live sports betting, and supports multiple payment options including major cryptocurrencies and fiat gateways like Visa and Mastercard.

How High Will LTC Price Go?

Based on current technical indicators and market sentiment, LTC faces immediate resistance at the 20-day moving average of $113.55. A successful break above this level could target the upper Bollinger Band at $121.28. However, the mixed news environment and competitive pressures may limit upside potential in the short term.

| Price Level | Significance | Probability |

|---|---|---|

| $121.28 | Upper Bollinger Band Resistance | Medium |

| $113.55 | 20-Day MA Resistance | High |

| $112.40 | Current Price | - |

| $105.81 | Lower Bollinger Band Support | Medium |

The MACD remains positive but shows signs of momentum slowing, suggesting any upward movement may be gradual rather than explosive.